Battery and Energy Storage Market Outlook 2025

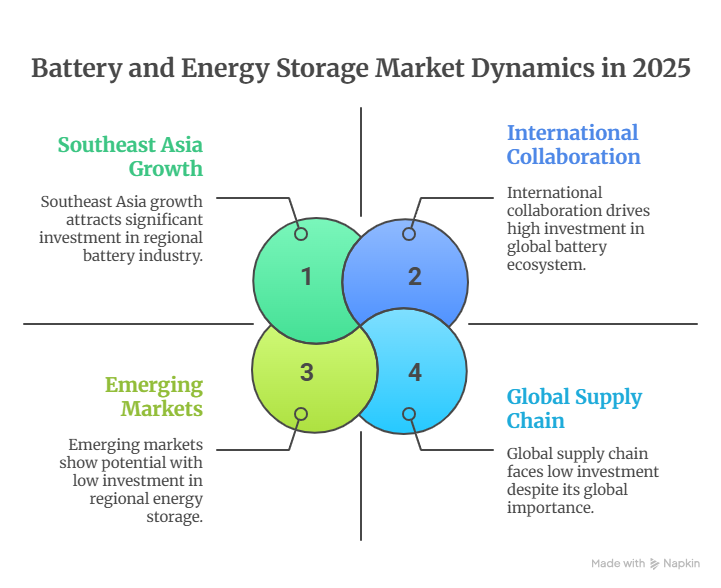

The global energy storage and battery industry is expanding at a pace few other sectors can match. Demand from electric mobility, renewable energy integration, and digital infrastructure is driving growth at unprecedented levels. Asia, particularly Southeast Asia, is emerging as a key force in this landscape, setting production benchmarks, driving technological progress, and shaping the market outlook for 2025 and beyond.

Southeast Asia in the Spotlight: Growth Potential and Regional Dynamics

Many countries in Southeast Asia have started investing heavily in the battery industry.

For instance, Thailand has positioned itself as a hub for EV assembly and component manufacturing, backed by incentives to attract international companies.

Vietnam is rapidly scaling up its domestic production capacity and strengthening links to global supply chains. Indonesia, with its vast nickel reserves, continues to draw strong interest from battery and EV producers, while the Philippines is emerging as a market with growing energy storage needs driven by its expanding power sector.

Government policies across the region are further motivating the investors.

Incentives for local production, renewable integration, and EV adoption are creating strong demand projections for the next decade. Industrial parks and special economic zones dedicated to energy storage and EV supply chains are becoming more common, further anchoring the region’s role in the global battery industry market.

The spirit of regional cooperation is also strengthening the global battery industry. Initiatives such as the ASEAN battery ecosystem and plans for greater cross-border grid integration show that Southeast Asia is working together to bring new innovations in the battery industry.

Investment Trends: Where Global Capital Is Flowing

Investor confidence in Asia’s energy storage market supply chain is strengthening, with capital flowing into every stage from raw material sourcing to recycling.

Utility-scale energy storage projects are attracting significant funding as renewable energy capacity expands. At the same time, investment in solid-state battery research is accelerating, reflecting the push to commercialize safer and higher-density chemistries. Battery energy storage systems connected to electric vehicles are also growing quickly, supporting transport electrification and offering new ways to improve grid stability.

Germany, Australia, and the United States have emerged as key cooperation and market entry targets for Asian businesses. Germany provides access to advanced research and Europe’s EV battery market, Australia offers critical minerals and is scaling downstream processing, and the United States is investing in supply chain security and new market opportunities.

International Collaboration: Building a Global Battery Ecosystem

Cross-border collaboration is becoming a defining feature of the battery industry. Partnerships between China and Southeast Asia are strengthening supply chains through joint ventures, technology transfer, and raw material processing agreements. Europe–Asia initiatives are also expanding, as European firms look to secure supply stability while Asian companies gain access to advanced research and downstream markets.

As battery supply chains become more interconnected, there is a growing need for standardisation, infrastructure alignment, and data sharing. There is a pressing need to establish common safety and performance standards to ensure interoperability across regions. Shared data platforms are also being discussed as a way to improve traceability and compliance across complex value chains.

China continues to hold the dominant position in global battery manufacturing. Chinese companies are not only scaling domestic production but also investing in overseas projects, from nickel mining in Indonesia to joint R&D centers in Europe. This outward cooperation signals that the next phase of growth will be defined less by competition and more by building an integrated global battery ecosystem.

Strategic Outlook: What’s Ahead for 2025 and Beyond

Moving forward, second-life batteries and circular economy models are getting mainstream. Companies are beginning to scale reuse and refurbishment programs, extending the life of EV and ESS batteries while reducing waste and lowering costs.

Artificial intelligence and digital platforms will play a greater role in market analysis and operations. From predicting demand patterns to optimising asset performance, AI is giving producers, utilities, and investors sharper insights.

The chemistry diversification is also changing the global battery industry landscape. While lithium batteries still remain popular, there is a growing attention toward sodium, sulfur, and hybrid chemistries. These alternatives promise lower costs, improved safety, and greater material availability, giving the industry more resilience against supply risks.

However, the rising challenges in the battery industry cannot be overlooked. Geopolitical tensions, raw material shortages, and stricter ESG compliance requirements are creating new layers of uncertainty. Companies in 2025 and beyond will need to strengthen supply chain resilience, maintain transparency, and adapt quickly to shifting global conditions to stay relevant in the market.

Wrapping-Up

The battery and energy storage market is entering a decisive phase. Growth in Southeast Asia, rising investment flows, stronger international cooperation, and a push toward new chemistries are all shaping the industry’s outlook for 2025. At the same time, companies must navigate supply risks, stricter ESG requirements, and shifting geopolitical dynamics.

The Battery Show Asia 2026 will be an important platform to follow these developments, register now to see firsthand how innovation is guiding the next stage of global energy storage!